Presidio Petroleum Announces Dividend Policy and Reinforces Differentiated Producing Oil and Gas Strategy

|

|

Presidio intends to initiate a dividend of $1.35 per share per annum, approved and paid quarterly

Fort Worth, TX, Feb. 05, 2026 (GLOBE NEWSWIRE) -- Presidio Investment Holdings LLC (“Presidio” or the “Company”), a differentiated oil and gas operator focused on the acquisition and optimization of mature, producing oil and natural gas assets in the United States, today reaffirmed its initial dividend framework and broader shareholder return strategy in conjunction with the previously announced business combination with EQV Ventures Acquisition Corp (NYSE: FTW) ("EQV").

Presidio’s strategy is designed for public market investors seeking a clear, repeatable income proposition, rather than exposure to drilling inventory, type curves, and reinvestment-heavy development programs. The strategy is to produce and acquire oil and gas assets, hedge commodity prices, maintain low operating costs, minimal capital expenditures, and return cash to shareholders. The Company believes the simplicity of this model supports a dividend approach that is transparent, stable and durable.

Initial Dividend Policy: Fixed and Designed to Grow Through M&A

Presidio expects to initiate a dividend of $1.35 per share per annum, to be approved and paid quarterly. The Company expects to provide formal dividend timing details promptly following completion of the transaction and approval by the Board of Directors of the post-business combination company.

Will Ulrich, Presidio Co-Founder and Co-CEO, said: “We’re offering investors a straightforward proposition: a $1.35 per share annual dividend, that we expect to be approved and paid quarterly. From there, our plan is to grow that dividend over time, not by outspending cash flow to drill, but by acquiring and optimizing high-quality assets and distributing cash flow through dividends to shareholders.”

Presidio intends to grow the dividend over time primarily through accretive acquisitions, supported by a favorable M&A environment for purchasing non-core assets at attractive returns.

Why Presidio Is Different: Not a Drilling Story

Presidio emphasizes that its business model is fundamentally different from high-decline E&P companies that must continuously reinvest significant capital into drilling new wells. Instead, Presidio is designed as a capital-light platform with minimal reinvestment requirements, enabling a greater portion of cash flow to be returned directly to shareholders. By centering the value proposition on disciplined cash flow management and shareholder distributions, with growth driven through M&A rather than drilling, Presidio believes it offers a differentiated alternative to traditional E&P companies whose capital allocation and payout profiles can be more volatile.

Acquisition Backlog: Defined and Actionable

Presidio’s dividend growth strategy is supported by a defined and screened acquisition backlog centered on acquiring cash-flow-positive, long-life PDP assets where Presidio can operate, reduce costs, and optimize production. In its public investor presentation, Presidio provided a set of near-term potential actionable targets spanning approximately $13 billion to $15 billion of aggregated opportunities, with individual opportunities ranging from approximately $160 million to $3.0+ billion in enterprise value. These opportunities are illustrative and reflect management’s acquisition screening and prioritization process.

Disciplined M&A: Underwriting Framework

Presidio’s acquisition underwriting is designed to drive dividend accretion while protecting dividend sustainability by managing leverage while seeking attractive long-term compound equity returns.

In its investor materials, Presidio illustrated a framework assuming acquisitions at approximately 20% free cash flow yield, funded with approximately 40% debt at 7% annual interest expense, with no incremental capex and targeting approximately 1.1x dividend coverage on pro forma cash flow. The result of these assumptions is increased dividends over time.

Trading Context: From “Cash-in-Trust” to Fundamentally Valued Dividend Equity

Unlike drilling-led E&P companies that require recurring capital programs to offset steep declines, Presidio is positioned as an operated, 100% PDP-focused platform emphasizing optimization and free cash flow durability. Presidio’s investor presentation highlights the potential for a 13% dividend yield supported by stable, hedged cash flow and low reinvestment requirements.

Presidio believes its model is differentiated because it pairs royalty-like cash flow stability with operator-level control—allowing for cost reductions, uptime improvements, and scalable integration of acquisitions—while maintaining a low reinvestment profile.

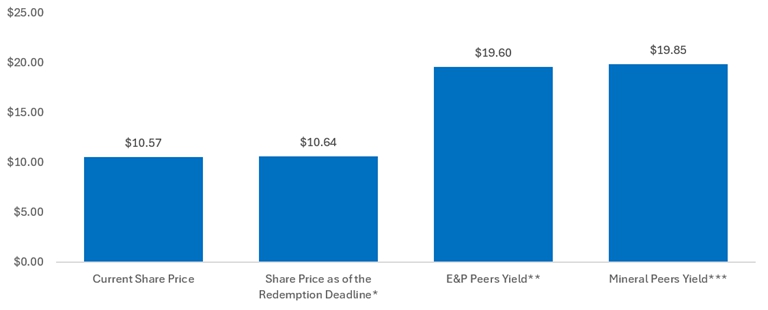

Presidio’s investor presentation explicitly benchmarks its model against E&P Peers and Mineral peers, indicating EQV’s shares are trading at a significant discount.

Shares Trading Below Peer Valuations Despite Comparable Asset Quality

* Share price is calculated based on the anticipated amount in trust as of February 25, 2026, the Redemption Deadline.

** E&P Peers are DEC, TXO, MNR, CRGY as of 1/2/26. All MLP's are shown as after tax dividends. Calculated by dividing $1.35 by implied dividend yield.

*** Mineral Peers are: BSM, KRP, and DMLP as of 1/2/26. All MLP's are shown as after tax dividends. Calculated by dividing $1.35 by implied dividend yield.

Transaction Update

On January 30th, 2026 the registration statement on Form S-4 relating to the previously announced business combination (the “Business Combination”) between EQV and Presidio was declared effective by the U.S. Securities and Exchange Commission. EQV shareholders will vote on the proposed business combination at an extraordinary general meeting scheduled for February 27, 2026, with the combined entity expected to trade on the New York Stock Exchange under the ticker symbol "FTW" upon closing.

About Presidio

Headquartered in Fort Worth, TX, Presidio is a leading operator of mature oil and gas wells across the Mid-Continent. The Company is focused exclusively on optimizing existing production and generating sustainable cash flow from low-decline, producing assets.

Dividends are not guaranteed and may be adjusted, suspended, or discontinued at the discretion of the Board of Directors based on liquidity, legal surplus, business conditions, commodity price volatility, market conditions and other factors.

About EQV Ventures Acquisition Corp.

EQV Ventures Acquisition Corp. (NYSE: FTW) is a blank check company incorporated as a Cayman Islands exempted company for the purpose of effecting a merger, amalgamation, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses or entities. EQV’s sponsor is an affiliate of EQV Group, which was formed in 2022 and is an active acquirer and operator of proved developed producing oil and gas properties, and currently owns and operates more than 3,500 wells across 10 states.

Forward-Looking Statements

This press release includes “forward-looking statements.” These include EQV’s, Presidio Pubco Inc’s (“Pubco”), EQVR’s or Presidio’s or their management teams’ expectations, hopes, beliefs, intentions or strategies regarding the future. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek,” “potential,” “budget,” “may,” “will,” “could,” “should,” “continue” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding Pubco’s, Presidio’s, EQVR’s and EQV’s expectations with respect to future performance, the timing and amount of any dividend payments; the ability to successfully complete acquisitions on attractive terms, or at all, the capitalization of EQV or Pubco after giving effect to the proposed Business Combination and expectations with respect to the future performance and the success of Pubco following the consummation of the proposed Business Combination. These statements are based on various assumptions, whether or not identified in this press release, and on the current expectations of Pubco’s, Presidio’s, EQVR’s and EQV’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied upon by any investors as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Pubco, Presidio, EQVR and EQV. These forward-looking statements are subject to a number of risks and uncertainties, including changes in business, market, financial, political and legal conditions; benefits from hedges and expected production; the inability of the parties to successfully or timely consummate the proposed Business Combination, including the risk that any regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect Pubco or the expected benefits of the proposed Business Combination or that the approval of the shareholders of EQV is not obtained; failure to realize the anticipated benefits of the proposed Business Combination, which may be affected by, among other things, competition, the ability of Pubco to grow and manage growth profitably, maintain key relationships and retain its management and key employees; risks related to the uncertainty of the projected financial information with respect to Presidio or Pubco; risks related to Presidio’s current growth strategy; the occurrence of any event, change or other circumstances that could give rise to the termination of any definitive agreements with respect to the proposed Business Combination; the outcome of any legal proceedings that may be instituted against any of the parties to the potential Business Combination following its announcement and any definitive agreements with respect thereto; changes to the proposed structure of the proposed Business Combination that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining regulatory approval of the proposed Business Combination; risks that Presidio or Pubco may not achieve their expectations; the ability to meet stock exchange listing standards following the proposed Business Combination; the risk that the proposed Business Combination disrupts the current plans and operations of Presidio; costs related to the potential Business Combination; changes in laws and regulations; risks related to the domestication of EQV as a Delaware corporation; risks related to Pubco’s ability to pay expected dividends; the extent of participation in rollover agreements; the amount of redemption requests made by EQV’s public equity holders; and the ability of EQV or Pubco to issue equity or equity-linked securities or issue debt securities or enter into debt financing arrangements in connection with the proposed Business Combination or in the future. Additional information concerning these and other factors that may impact such forward-looking statements can be found in filings and potential filings by Presidio, EQV, EQVR or Pubco resulting from the proposed Business Combination with the SEC, including under the heading “Risk Factors” in the Registration Statement. If any of these risks materialize or any assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that none of Pubco, Presidio, EQVR nor EQV presently know or that Pubco, Presidio, EQVR or EQV currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on by investors as a guarantee, an assurance, a prediction or a definitive statement of fact or probability.

In addition, forward-looking statements reflect Pubco’s, Presidio’s, EQVR’s and EQV’s expectations, plans or forecasts of future events and views as of the date they are made. Pubco, Presidio, EQVR and EQV anticipate that subsequent events and developments will cause Pubco’s, Presidio’s, EQVR’s and EQV’s assessments to change. However, while Pubco, Presidio, EQVR and EQV may elect to update these forward-looking statements at some point in the future, Pubco, Presidio, EQVR and EQV specifically disclaim any obligation to do so, except as required by law. These forward-looking statements should not be relied upon as representing Pubco’s, Presidio’s, EQVR’s or EQV’s assessments as of any date subsequent to the date they are made. Accordingly, undue reliance should not be placed upon the forward-looking statements. None of Pubco, Presidio, EQVR or EQV, or any of their respective affiliates have any obligation to update these forward-looking statements other than as required by law.

Additional Information and Where to Find It

In connection with the proposed Business Combination, Pubco, EQVR and Presidio filed the Registration Statement with the SEC, which includes a prospectus with respect to Pubco’s securities to be issued in connection with the proposed Business Combination and a proxy statement with respect to the shareholder meeting of EQV to vote on the proposed Business Combination. EQV, Pubco, EQVR and Presidio also plan to file other documents and relevant materials with the SEC regarding the proposed Business Combination. The Registration Statement was declared effective by the SEC on January 30, 2026. Mailing of the definitive Proxy Statement/Prospectus to EQV’s shareholders of record as of January 30, 2026 commenced on January 30, 2026. The Proxy Statement/Prospectus includes information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to EQV’s shareholders in connection with the proposed Business Combination. SECURITY HOLDERS OF EQV AND OTHER INTERESTED PARTIES ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS AND RELEVANT MATERIALS RELATING TO THE PROPOSED BUSINESS COMBINATION THAT HAVE BEEN AND WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BEFORE MAKING ANY VOTING DECISION WITH RESPECT TO THE PROPOSED BUSINESS COMBINATION BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED BUSINESS COMBINATION AND THE PARTIES TO THE PROPOSED BUSINESS COMBINATION. Shareholders are able to obtain free copies of the Proxy Statement/Prospectus and other documents containing important information about Pubco, Presidio, EQVR and EQV once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. In addition, the documents filed by EQV may be obtained free of charge from EQV at www.eqvventures.com. Alternatively, these documents, when available, can be obtained free of charge from EQV or Pubco upon written request to EQV Ventures Acquisition Corp., 1090 Center Drive, Park City, Utah, 84098, Attn: Secretary, or by calling (405) 870-3781. The information contained on, or that may be accessed through the websites referenced in this press release is not incorporated by reference into, and is not a part of, this press release.

Participants in the Solicitation

EQV, Presidio, EQVR, Pubco and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of EQV in connection with EQV’s shareholder meeting. Security holders may obtain more detailed information regarding the names, affiliations and interests of certain of EQV’s executive officers and directors in the solicitation by reading EQV’s annual report on Form 10-K, filed with the SEC on March 31, 2025, the definitive Proxy Statement/Prospectus, filed with the SEC on January 30, 2026, the Registration Statement and other relevant materials filed with the SEC in connection with the proposed Business Combination when they become available. Information concerning the interests of EQV’s participants in the solicitation, which may, in some cases, be different from those of EQV’s shareholders generally, is set forth in the definitive Proxy Statement/Prospectus and the Registration Statement.

No Offer or Solicitation

This press release shall not constitute a solicitation of any proxy, vote, consent or approval in any jurisdiction in connection with the proposed Business Combination and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of EQV, PIH, EQVR or Pubco, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended. This press release is restricted by law; it is not intended for distribution to, or use by any person in, any jurisdiction in where such distribution or use would be contrary to local law or regulation.

Presidio Media and Investor Contact:

For EQV:

Source: EQV Ventures Acquisition Corp.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.